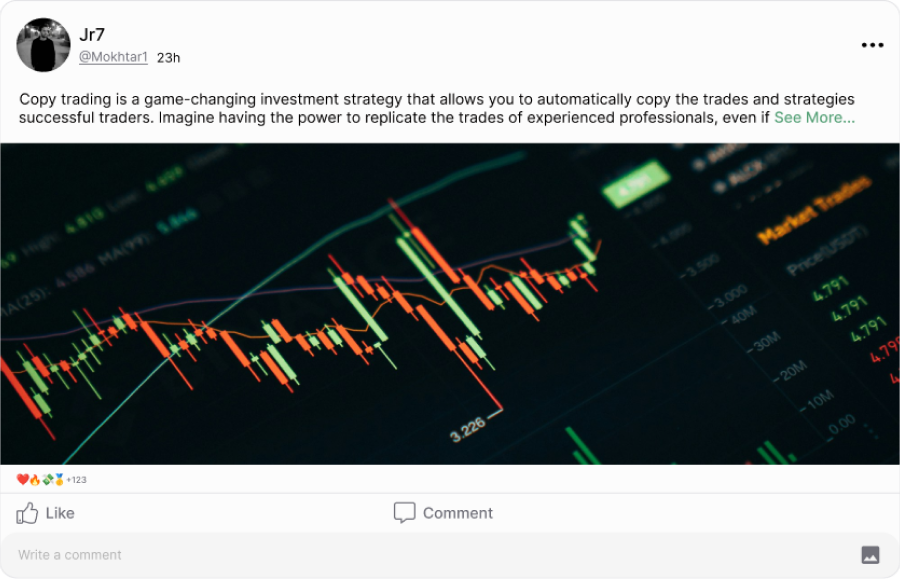

What Is Copy Trading?

- Copy trading is a form of trading where investors replicate the trades of experienced traders, often referred to as "signal providers" or "masters," within a social trading platform, in real time.

- Copy trading rewards successful traders by getting paid for their results and enables inexperienced ones to leverage the expertise and insights of seasoned traders.

- By offering copy trading, you enable all types of traders to profit, increasing the number of trades executed on your platform and boosting your revenue.

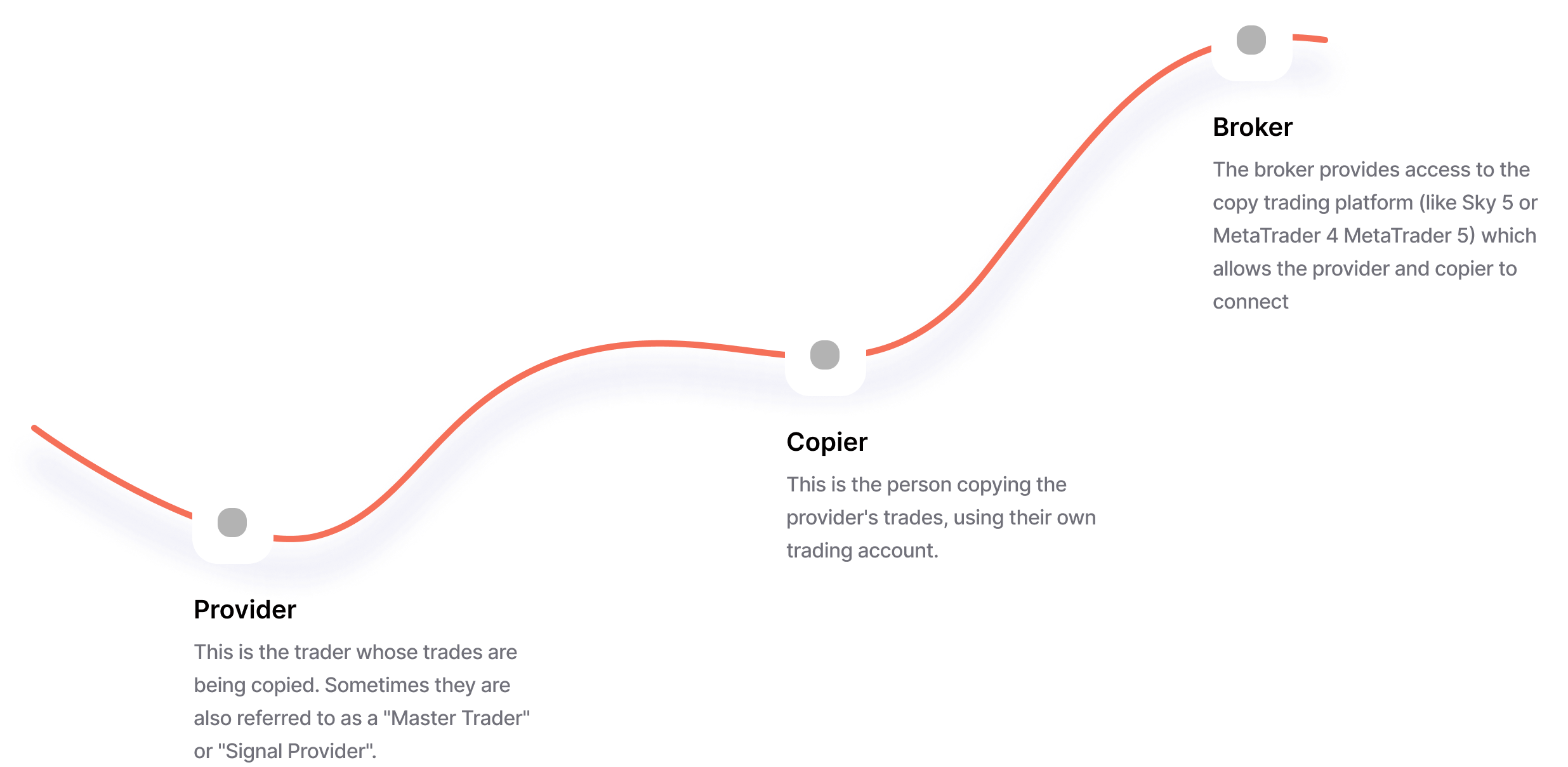

How it works.

Setup

set up a fully customizable copy trading platform where clients can access a list of experienced traders and their trading strategies.

Signal Providers

Experienced traders, AKA "signal providers" or "masters," join the platform and allow their trades to be copied by other users.

Client Registration

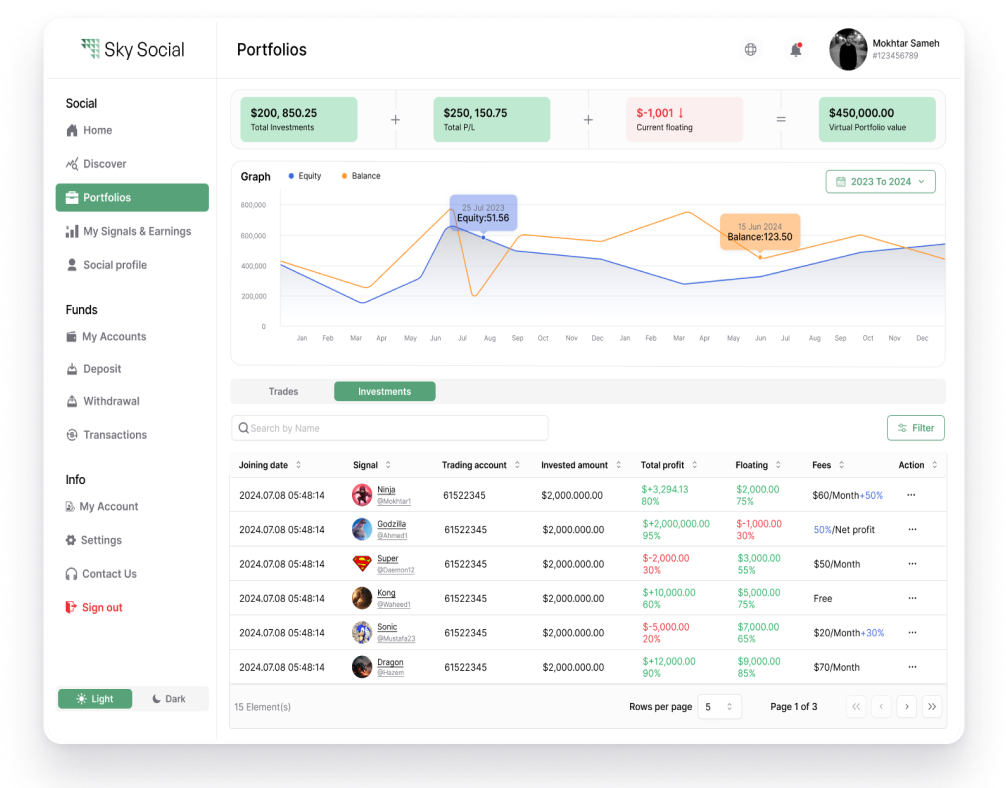

Clients sign up to the copy trading platform and choose the signal providers they want to copy.

Funds Allocation

Clients allocate a portion of their capital to copy the trades of selected signal providers, specifying the amount to allocate to each provider based on their preferences.

Trade Replication

Whenever a signal provider makes a trade, it is automatically replicated in the accounts of clients who are copying that provider. The size of the trade in each client's ...

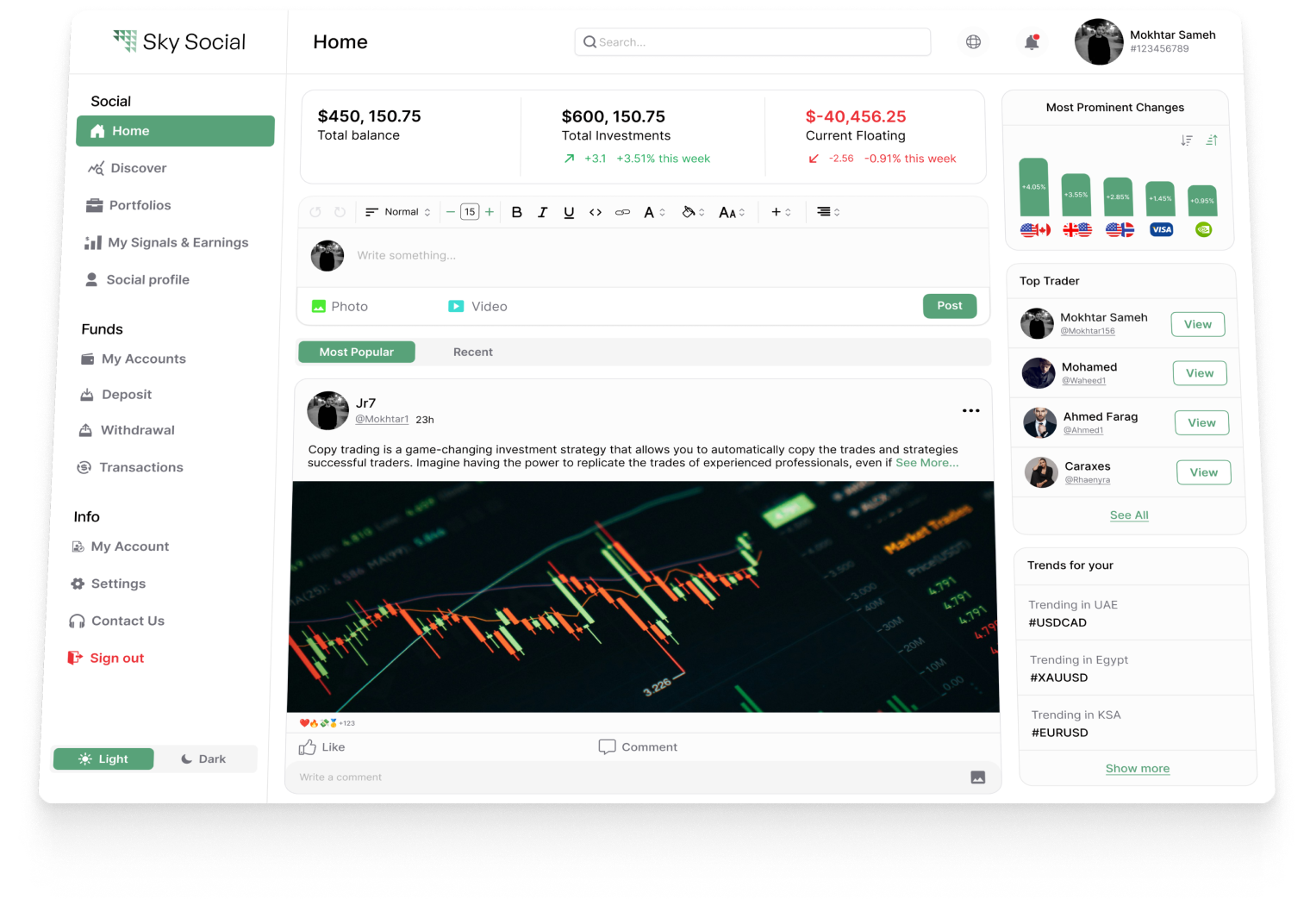

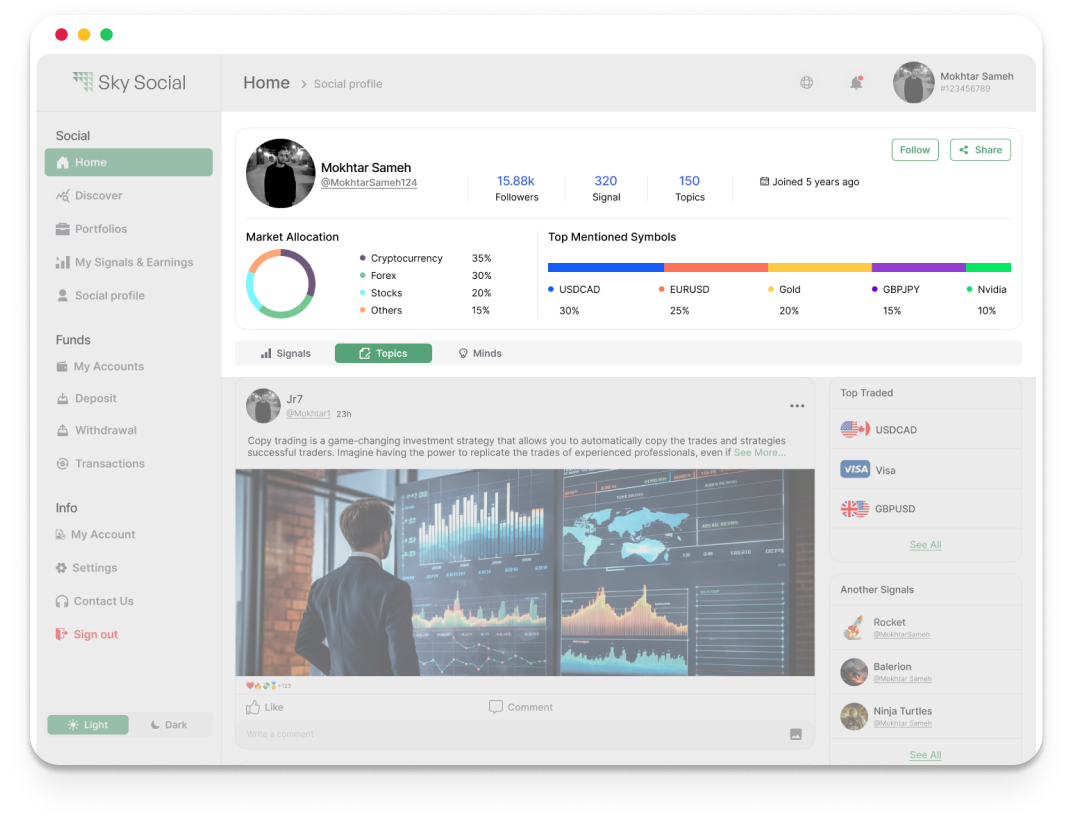

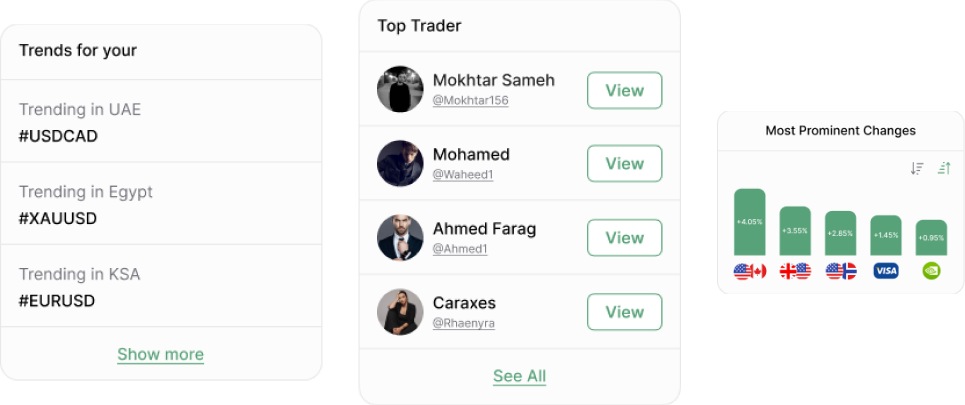

About Sky Social

In Sky Social, it’s all about the community. We help you build the future of your traders by enabling them to share knowledge and analyse real-time trends and market news through social engagement.

Social Interaction

“ Enable traders to comment, rate, and review masters to facilitate communication and collaboration among users and signal providers, promoting the more successful ones.”

Social Sentiment Analysis

“ With social media sentiment analysis tools, you can gauge market sentiment and identify emerging trends and enable users

to follow popular sentiment-driven strategies.”

Community Collaboration

“ Enable traders to comment, rate, and review masters to facilitate communication and collaboration among users and signal

providers, promoting the more successful ones.”

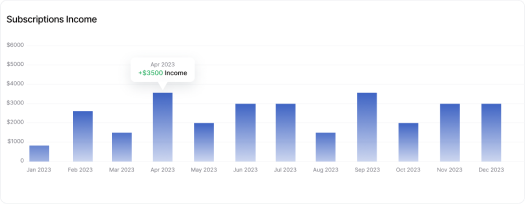

Reports & Analytics

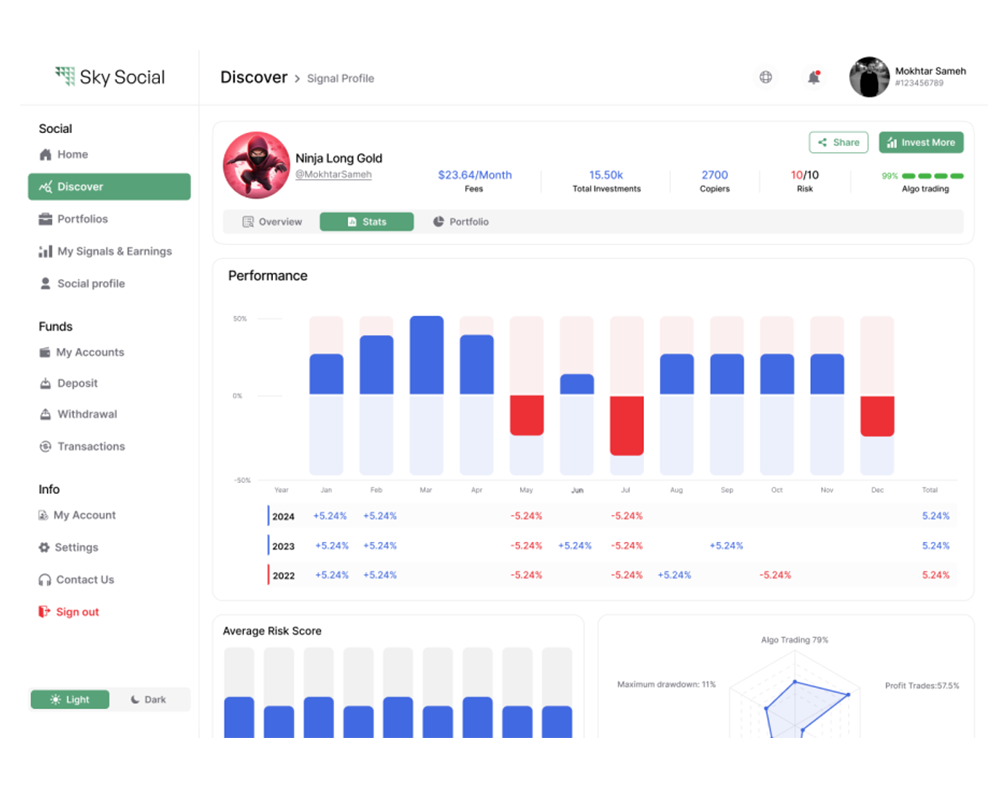

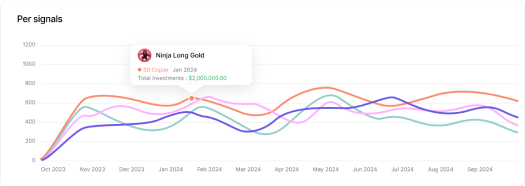

We believe in the power of data and offer traders detailed insights into the performance of signal providers and the impact of market events, trading strategies, and risk factors on portfolio performance.

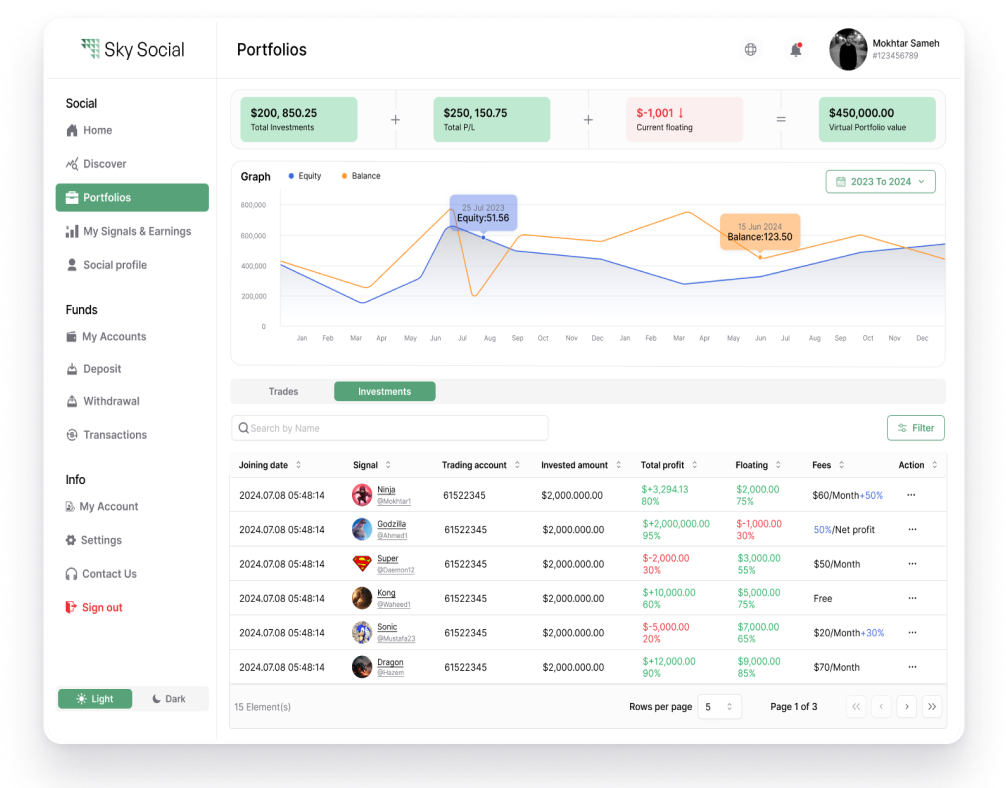

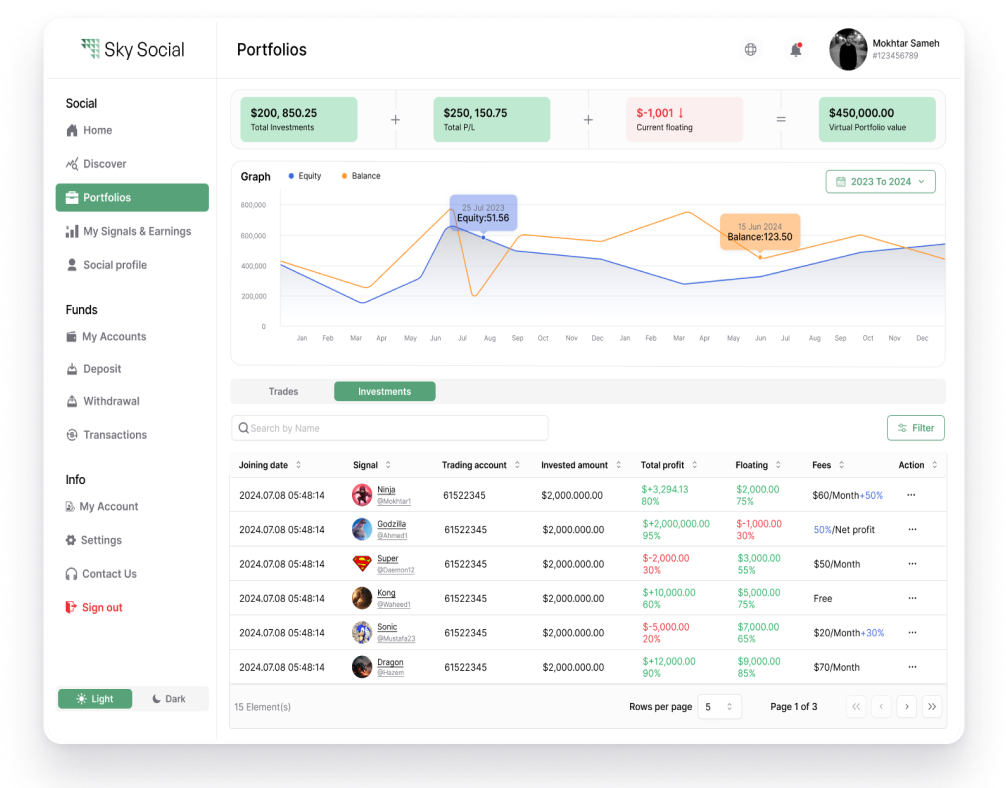

Real-Time Data Visualization

Interactive dashboards and real-time data visualization tools that provide users with actionable insights into portfolio performance, trade history, risk exposure, and market trends.

Quantitative Analysis

Access to advanced quantitative analysis tools, backtesting platforms, and strategy builders that enable users to develop, test, and optimize their own trading strategies for copy trading.

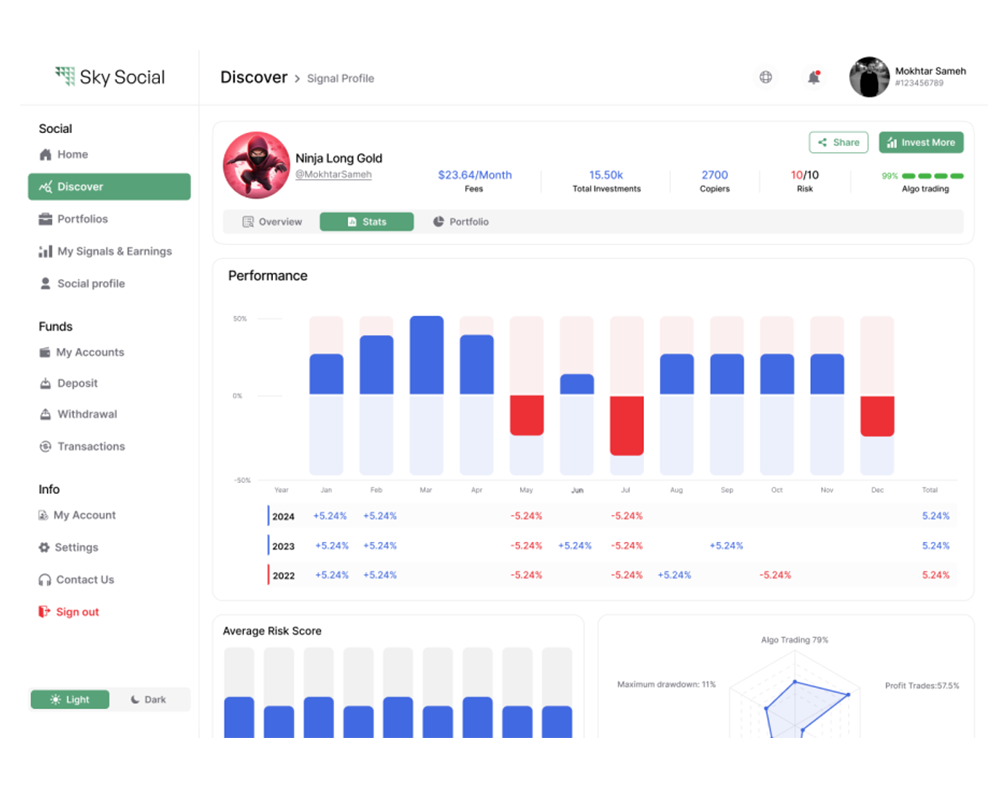

Performance Attribution

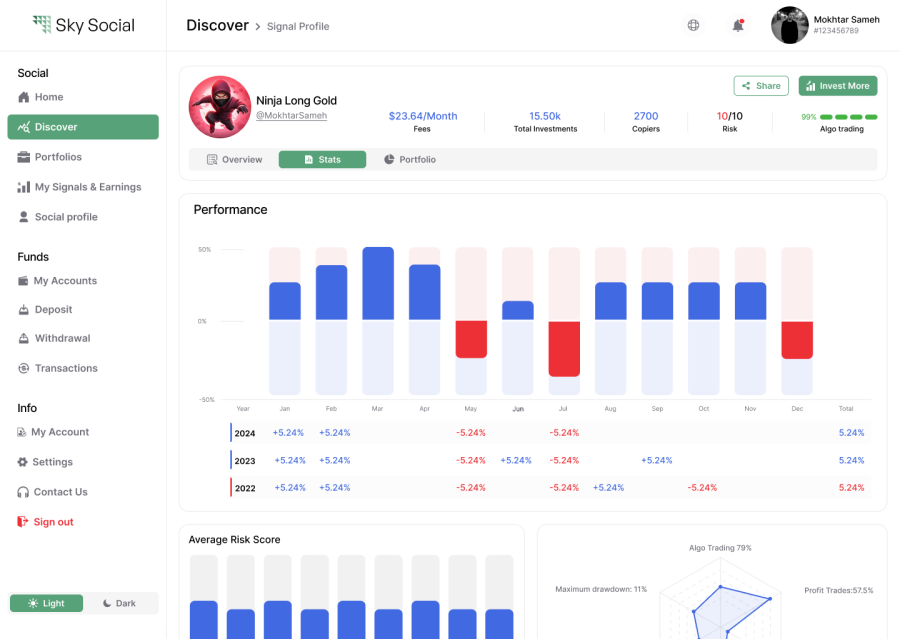

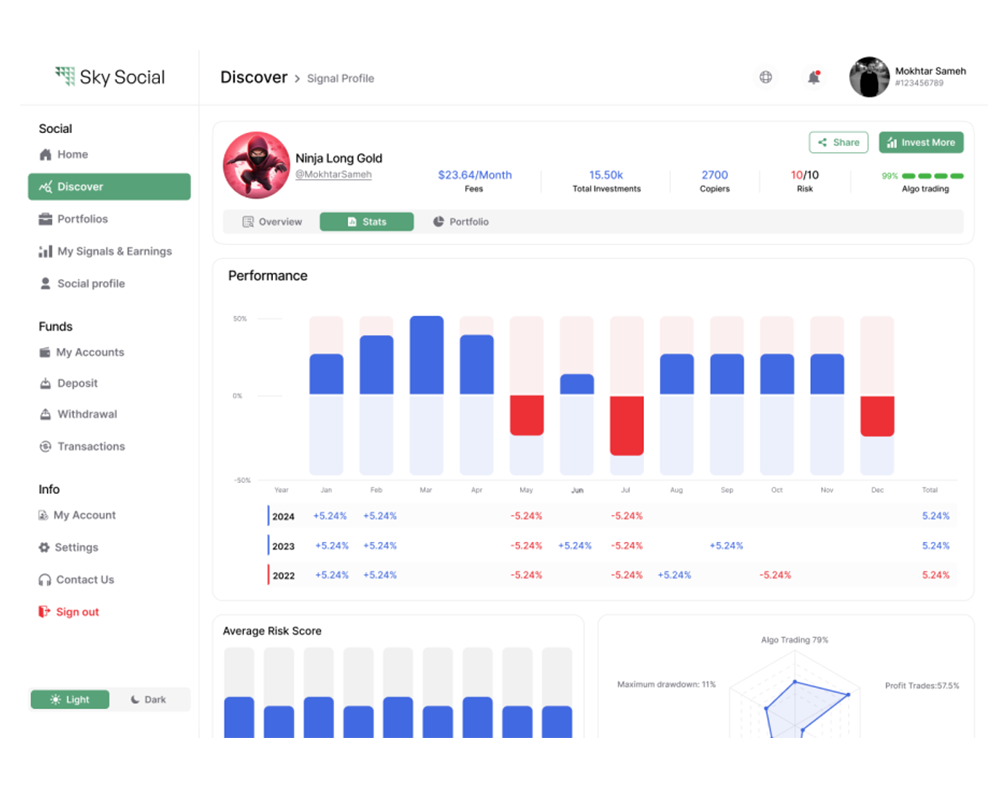

Transparent performance metrics, including historical returns, drawdowns, win rates,

and other statistics to help users evaluate

signal providers effectively.

Complete Master Profiles

Detailed profiling of signal providers that includes their trading performance, strategy description, risk level, and full trading history.

Real-Time Alerts

Alerts and notifications keep traders informed of new trades, changes in signal provider performance, or important market events that impact their copy trading portfolio.

We provide these alerts in real time.

Machine Learning Algorithms

Advanced algorithms that analyze vast amounts of trading data to identify successful trading strategies and masters, putting investors on

the right track and rewarding more

successful signal providers